A regular column by Daniel Renner

Articles published earlier in this column have described the three main financial statements which are commonly used as a fundamental tool to understand the health of a company. Balance sheets were discussed in an article published in the April 2020 issue of the IEEE Photonics Society Newsletter (Vol. 34, No. 2; pages 11–14). Income Statements and Cash Flow Statements were discussed in an article published in the June 2020 issue of this same Newsletter (Vol. 34, No. 3; pages 10–13). The IEEE Photonics Society Newsletter is published in print and also online, you can find past issues here: https:// www.photonicssociety.org/publications/photonics-newsletter/ past-issues.

Balance Sheets show what a company owns and what it owes at a fixed point in time. Income Statements show how much money a company made and spent over a past period of time. Cash Flow Statements show how money has been exchanged between a company and the outside world, also over a past period of time. These three financial statements are backwards looking, they describe what has happened in the company from some point in the past to the present.

It is crucial for the successful management of a company to also have forward looking tools, that can forecast the financial status of the company from the present to some point out in the future. This will take us into the fascinating field of predictions and forecasts which, as we all know, is hugely complex and a very difficult endeavor. It is hard enough to understand what happened in the past, to try to predict the future is very challenging. Many books have been written on this topic and the objective of this article is to give you a few thoughts on the nature of predictions and describe a few tools to manage them. Further recommended reading is indicated in the list of references at the end of the article.

There is a large collection of interesting quotes about predictions and forecasts, here are a few samples:

These four quotes convey in different ways the fact that predicting the future is a difficult task and the last two quotes add some interesting thoughts:

- It is extremely useful to consider several possible future scenarios when developing a prediction or forecast.

- A powerful consideration is that when you are predicting possible future outcomes for your company, you have the power to try to make those outcomes happen! The future has a component of randomness and at the same time you have the power to influence it! As a businessperson, you must apply all your effort to make the future happen such that it meets your vision, the best you can.

Cash Flow Forecast

The most important financial forecasting tool is the Cash Flow Forecast, which will tell you whether you are going to have enough funds to sustain the continuous operation of the business or not. It is absolutely essential!

Cash is flowing into your business from customers who are buying your products and/or services, creating an income stream. Cash is also flowing in from investors, loans, lines of credit, interest received and asset sales.

Cash is flowing out in the form of payments and expenses, like payroll, other employee costs (like health insurance), rent, materials and supplies, services, interest paid, asset purchases and taxes.

Cash Flow Forecasts describe the time profile of cash flowing in and out of the business. Timing of the flow is very important. For example, customers not paying on time is one of the biggest cash flow issues small businesses face and is one of the big reasons that many startups fail within the first year.

A cash flow forecast is a plan that shows how much money you expect to receive, and how much money you expect to pay out, at various points over a set length of time. Cash flow is all about keeping enough cash in hand by monitoring when transactions happen. Paying attention to when money is due to come in and go out will help you avoid getting into serious trouble.

Some business owners like to plan over the course of 12 months, while others prefer to focus in on shorter periods of say 6 months at a time. I recommend having a cash flow forecast of 18 to 24 months for a photonic startup. This will give you enough visibility, over at least 18 months, to provide sufficient time to react to possible issues and opportunities.

The availability of cash as the business starts is fundamental. Startups have a large number of costs in their setup period. This large negative cash flow can be offset by external investments until sales have had a chance to grow. Alternatively, a startup can “bootstrap” itself up and these initial investments are spread out over a longer period of time, as the business generates cash from sales to pay for them. This option makes for a slower start but there is no loss of company ownership. All of these funding methods can be successfully used, it will depend on the specific circumstances of the business and what the business owners prefer.

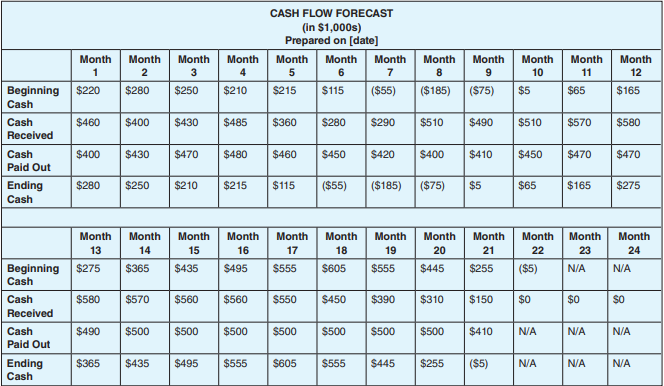

The table below shows an example of a Cash Flow Forecast looking 24 months ahead. Cash Flow Forecasts are also known as Projected Cash Flow or Cash Flow Runway.

A few observations regarding the Cash Flow Forecast indicated above:

- The company will not have enough cash to sustain operations on months 6, 7 and 8. This is due to a reduction in the cash received forecast for months 5, 6 and 7. Understanding this potential problem requires immediate attention! You can increase cash received or reduce cash paid out. Cash paid out can be reduced by delaying payment to suppliers, with their agreement, of course. Accelerating payments by customers can increase cash received. In general, asking for payment up front or at least a partial payment up front is an effective way to protect your cash flow.

You can also get a loan for $185K or borrow from a line of credit to cover the cash deficit. The loan can be paid back, in this case, by month 9. Do your best to get a line of credit early on in your business life so that you have the flexibility to handle cash flow fluctuations. Getting a line of credit might require placing your personal assets as a guarantee, which demands very careful consideration, of course. Opportunity and risk always go hand in hand. - Other than the dip in cash received on months 5, 6 and 7, the forecast shows growth on this item from mid $400Ks per month initially to high $500Ks in months 11 – 17. Cash paid out also grows from the low $400Ks to $500Ks. Larger sales and larger expenses, the company is predicted to grow! This forecast is a prediction and a goal at the same time. Stick to your goals! Make it happen!

- The continuous reduction in cash received starting in month 18 is because sales visibility starts being opaque beyond that point. Even so, the cash forecast indicates that the company has enough work to last for 21 months, without any additional sales beyond what has been already recorded. This is a good work backlog number, in a photonic startup this number should be in the 18 to 22 months range. At the end of every month, future visibility will improve and sales that are 18 months out or so will become clearer. It is a good target to keep a rolling “runway” of 18 to 22 months.

- Months 22, 23 and 24 indicate N/A because we do not know enough that far out in the future at this point. It is beyond our point of visibility. You can study various possible scenarios for what might happen in the outer six months.

A great deal of understanding about these tools and many other business aspects can be found in the book “What it Takes to be an Entrepreneur” [1] by my good friend Leon Presser, who is a very successful high tech entrepreneur.

In a high tech startup company you need a fresh Cash Flow Forecast report at least every month, ideally every week, if not every day! This is your radar, indicating possible financial obstacles ahead. It is also important to compare the forecast to your actual cash flow, so that you can see how closely the numbers match up and improve your forecasting ability. Timely review of the Cash Flow Forecast, hopefully weekly, is a necessary condition for growing your business and for survival!

The Cash Flow Forecast should be supported by additional layers of reports providing more detail, such as:

- Sales forecast

- Accounts receivable

- Accounts payable

- Payroll and employee costs forecast

- Materials spending forecast

Finally, a few words on the psychology of forecasting. All human beings are subject to cognitive biases, patterns of deviation from norm and/or rationality of judgment. We predict based on our perception of reality which is somewhat distorted, it is biased. These biases have been extensively studied in psychology and behavioral economics, we need to become aware of their presence and try to compensate for them. Daniel Kahneman and Amos Tversky [2], for example, did seminal research to understand the biases that limit the accuracy of our predictions. Nassim Nicholas Taleb [3] has developed great insight into our ability to predict, or lack thereof. There is no simple path to overcome these biases but some examples of mitigating action include:

- Use as wide a distribution of information as possible, using other ventures similar to the one being forecasted. Use other people’s experience.

- Also “organizations face the challenge of controlling the tendency of people competing for resources to present overly optimistic plans. A well-run organization will require planners for precise execution and penalize them for failing to anticipate difficulties, and or failing to allow for difficulties that they could not have anticipated—the unknown unknowns” [2].

Do not worry if some of your forecasts and predictions end up being wrong. Learn from your mistakes. Experience and understanding will improve your ability to predict. Besides, you will be in good company. Consider the following predictions:

blood on the stage.” – Charlie Chapman, English actor and film maker

Predicting can be a lot of fun, particularly when you get it

right. Consider the following predictions:

Looking for high tech opportunities, taking calculated risks to address those opportunities, predicting possible outcomes, do make photonic startups a wonderful place where to work and thrive. Life at a photonics startup is an incredibly full experience, involving technology, finance, psychology and many other aspects of what makes us human.

Predicting and forecasting is a rich, complex and crucially important business subject. I hope that this article has stimulated you to learn more about this topic, which is absolutely necessary to managing a successful photonics startup. If you have any questions or comments please contact me at ipsnewsletter@ieee.org

References

[1] Presser, Leon; “What it Takes to be an Entrepreneur – A Navigational Guide to Achieve Success”; Resserp Publishing; 2010

[2] Kahneman, Daniel; “Thinking, Fast and Slow”; Penguin Books; 2011

[3] Taleb, Nassim Nicholas; “The Black Swan”; Random House; 2010

About the Column

This is a regular column that explores business aspects of technology-oriented companies and in particular, the demanding business aspects of photonics startups. The column touches on topics such as financing, business plan, product development methodology, program management, hiring and retention, sales methodology and risk management. That is to say, we include all the pains and successes of living the photonics startup life.

This column is written sometimes by me (Daniel Renner) and sometimes by invited participants, so that we can share multiple points of view coming from the full spectrum of individuals that have something to say on this topic. At the same time, this is a conversation with you, the reader. We welcome questions, other opinions and suggestions for specific topics to be addressed in the future.

The expectation is that this column will turn into a useful source of business-related information for those who intend to start, join, improve the operation, fund, acquire or sell a photonic startup. A fascinating area that I have been one of those lucky to enjoy as a way of living for a

long time.

A Bit About Me

I (Daniel Renner) grew up in the wilderness of Chilean Patagonia, which is one of the sources of my quest for adventure and for exploring new areas. In my early twenties I went to the University of Cambridge in England to do a Ph.D. in Opto-Electronics, a new area at the time. Now, decades later, I have lived through the whole range of experiences that relate to the development, manufacturing and commercialization of complex photonic devices and systems used in communication, sensor and industrial applications. My experience spans both technical and business aspects of photonic products. This experience has included both large and small companies, which gives me a reasonable vantage point to comment on the ups and downs of life in a photonics startup.

I am currently Chief Business Development Officer at Freedom Photonics in Santa Barbara, CA, and I look forward to the regular conversation to be carried out through this column!